Hydra Tech Insights

Stay updated with the latest in technology and gaming.

On-Chain Transaction Analysis: Unmasking the Secrets Beneath the Surface

Dive deep into on-chain transaction analysis and discover hidden insights that could transform your crypto strategy today!

Understanding On-Chain Transaction Analysis: Key Concepts and Techniques

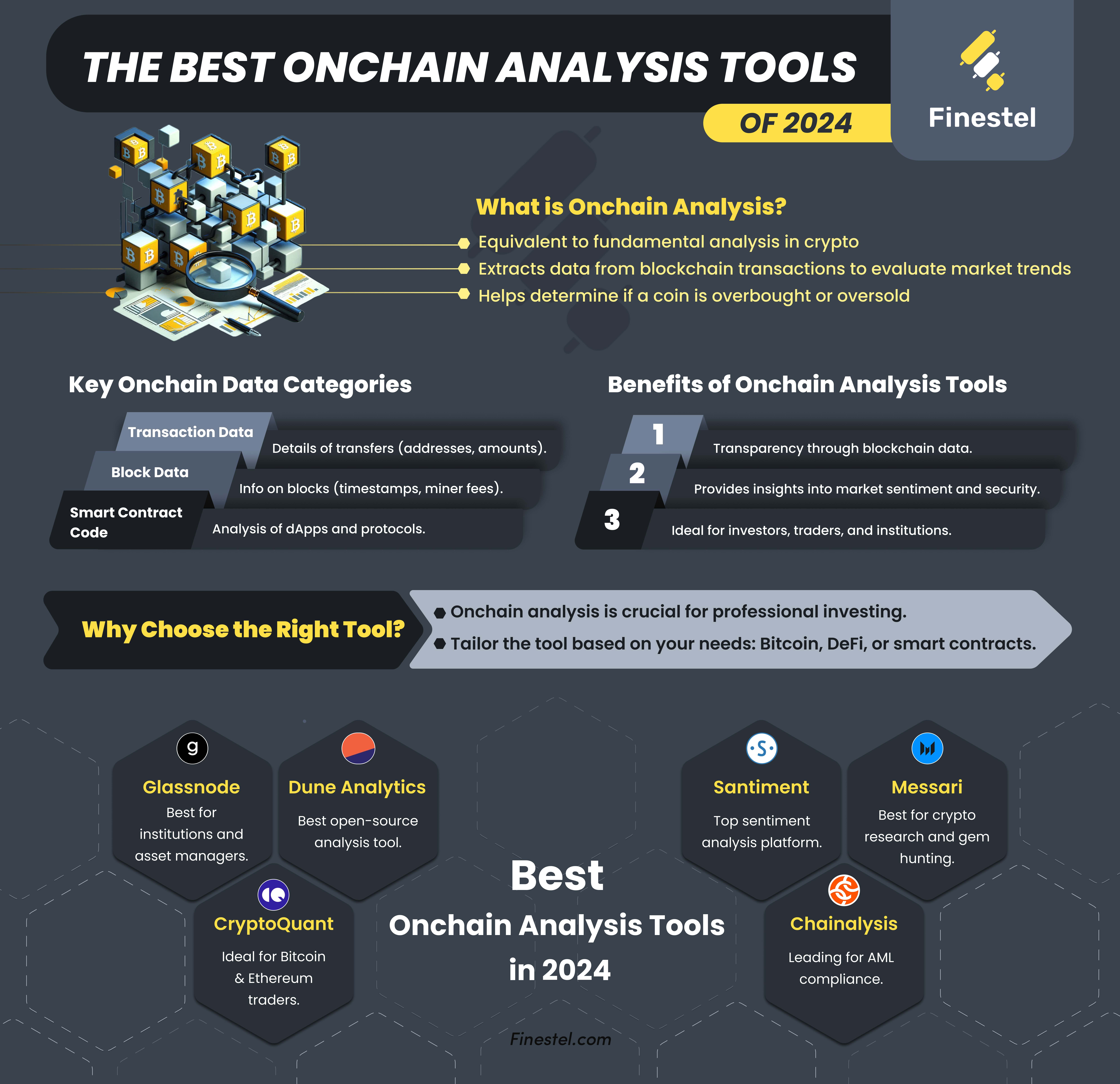

Understanding on-chain transaction analysis is fundamental for anyone looking to navigate the blockchain ecosystem effectively. This process involves examining the transactions recorded on a blockchain to gather insights into user behavior, transaction patterns, and overall network health. Key concepts in on-chain analysis include wallet addresses, which serve as unique identifiers for users; transaction hashes, the unique identifiers for individual transactions; and block height, which indicates the position of a block within the blockchain. By utilizing these concepts, analysts can track the flow of assets and understand liquidity trends in various cryptocurrencies.

Several techniques are employed in on-chain transaction analysis to derive meaningful interpretations from data. One common technique is graph analysis, which visualizes the relationships between addresses to identify clusters of activity. Another approach involves examining transaction volumes and fee structures to determine the cost-effectiveness of transactions. Additionally, techniques such as coin aging analysis and flow analysis help analysts understand the lifecycle of assets within the blockchain. By mastering these techniques, individuals can gain a competitive edge in investment decisions and enhance their understanding of market trends.

Counter-Strike is a highly popular first-person shooter game that has captivated millions of players worldwide. It emphasizes teamwork, strategy, and skill, where players can choose to be part of the terrorist or counter-terrorist teams. For those interested in enhancing their gaming experience, you can use a bc.game promo code to get some exciting bonuses.

How On-Chain Analytics Can Reveal Hidden Insights into Blockchain Activities

On-chain analytics has emerged as a powerful tool for exploring the complex tapestry of blockchain activities. By analyzing the data stored on the blockchain, businesses and researchers can uncover hidden insights that were previously unreachable. This method taps into transaction patterns, wallet interactions, and network activities, providing a comprehensive view of how different entities engage within the ecosystem. For instance, by tracking the flow of funds, analysts can identify major players and observe trends that could indicate market shifts or investment opportunities.

Furthermore, on-chain analytics allows for enhanced transparency and security within the cryptocurrency space. With the ability to scrutinize transaction history and wallet balances, stakeholders can mitigate the risks associated with fraud and illicit activity. Key metrics derived from these analytics, such as active addresses, transaction volumes, and miner activities, contribute significantly to refining strategies for both investments and regulatory compliance. As the blockchain landscape continues to evolve, leveraging on-chain analytics will be crucial for staying ahead in this dynamic environment.

What Can On-Chain Transaction Patterns Tell Us About Market Behavior?

On-chain transaction patterns provide invaluable insights into market behavior, allowing analysts to gauge the sentiment and activity levels of various participants in the cryptocurrency market. By examining the volume and frequency of transactions, one can identify trends such as accumulation or distribution phases. For instance, if a significant increase in transactions occurs during a price rally, it often indicates strong buying interest, signifying bullish sentiment among investors. Conversely, if transactions spike as prices fall, it may point to panic selling or profit-taking behavior, revealing a bearish trend.

Moreover, the analysis of on-chain transaction patterns can reveal key information about the distribution of wealth within the blockchain ecosystem. By observing large wallets, known as whales, and their activities, analysts can determine whether these entities are accumulating or distributing their assets. This information can be crucial for smaller investors, as whale movements often precede significant price shifts. Understanding these patterns helps market participants make informed decisions, ultimately contributing to better risk management and investment strategies.