Hydra Tech Insights

Stay updated with the latest in technology and gaming.

Crypto Market Rollercoaster: Navigating the Ups and Downs of Volatility

Strap in for the wild ride! Discover expert tips to conquer crypto volatility and ride the market waves like a pro.

Understanding Crypto Market Volatility: What You Need to Know

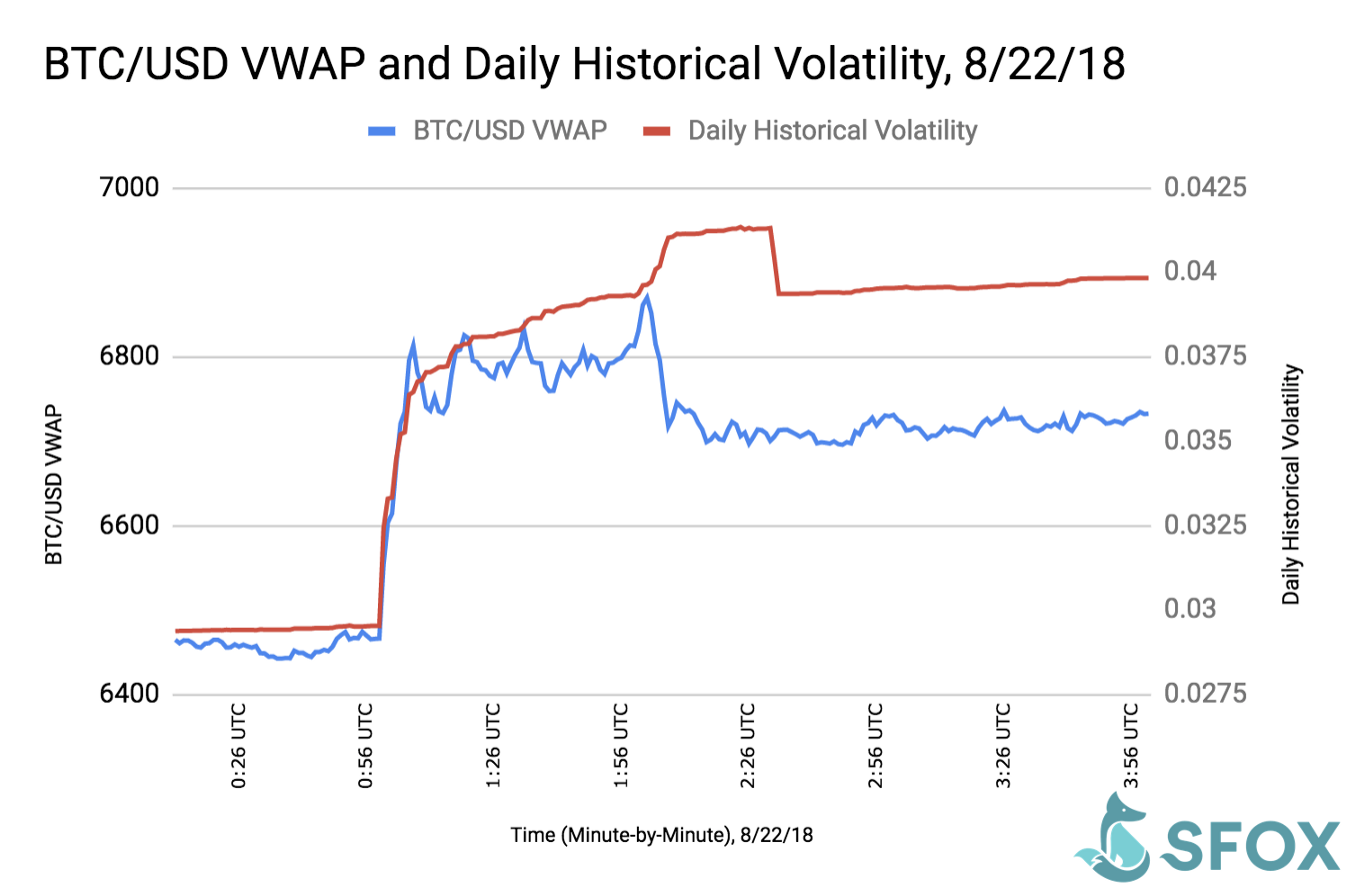

Understanding crypto market volatility is essential for both newcomers and seasoned investors in the cryptocurrency space. The prices of digital currencies can fluctuate wildly within short periods, driven by various factors ranging from market sentiment to regulatory news. One key reason for this volatility is the relatively low market capitalization of many cryptocurrencies compared to traditional financial markets. Consequently, even small amounts of capital can significantly influence prices. Additionally, the highly speculative nature of crypto investments often leads to wild price swings as traders react to news and hype.

Another factor contributing to crypto market volatility is the impact of external events. For example, regulatory announcements, technological advancements, or security breaches can lead to sudden market reactions. Investors must also be aware of the role of market manipulation, often referred to as 'whales'—large holders of cryptocurrencies who can move the market with their trades. To navigate this volatility, it is advisable to employ risk management strategies, such as diversifying your portfolio and setting stop-loss orders. By understanding these dynamics, investors can make informed decisions in an unpredictable market.

Counter-Strike is a highly competitive first-person shooter game that has garnered a massive following since its inception. Players can join either the Terrorist or Counter-Terrorist team, and the goal is to complete objectives such as bomb planting or hostage rescue. Many players enjoy enhancing their gaming experience through various promotions; for instance, you can find great offers using a cloudbet promo code to make your gaming even more exciting.

Top Strategies for Successfully Navigating the Crypto Market Rollercoaster

Navigating the crypto market can feel like riding a rollercoaster, with its rapid price swings and unpredictable trends. To successfully maneuver through this volatile landscape, it's essential to implement strategic approaches. First, staying informed is crucial. Regularly check reliable news sources and follow updates from reputable crypto influencers and analysts. Additionally, consider utilizing tools such as price tracking apps and social media sentiment analysis to gauge market perceptions.

Another important strategy involves diversification. Instead of putting all your funds into a single cryptocurrency, spread your investments across multiple assets. This can help mitigate risks and enhance potential rewards. Setting a budget and sticking to it is also vital; invest only what you can afford to lose. Finally, don't forget the importance of emotional control. The excitement of crypto trading can lead to rash decisions. By keeping a level head and following your strategy, you can better navigate the market's ups and downs.

How Do Market Trends and News Impact Cryptocurrency Prices?

Market trends and news play a crucial role in shaping cryptocurrency prices. When positive news emerges, such as regulatory approval or technological advancements, it often leads to increased investor confidence, driving prices higher. Conversely, negative news, like security breaches or regulatory crackdowns, can trigger panic selling, resulting in significant price drops. For instance, during periods of widespread media coverage on Bitcoin's adoption by major companies, the price tends to surge as retail and institutional investors enter the market, hoping to capitalize on the upward momentum.

Moreover, market trends reflect the collective sentiment of investors, often influenced by social media, expert analyses, and market reports. Traders closely monitor these trends through various technical indicators and patterns to make informed decisions. According to a study, about 70% of cryptocurrency traders utilize sentiment analysis tools to gauge market mood. This indicates that understanding current events and market sentiment can provide valuable insights into potential price movements, allowing investors to strategize effectively in the volatile cryptocurrency market.