Hydra Tech Insights

Stay updated with the latest in technology and gaming.

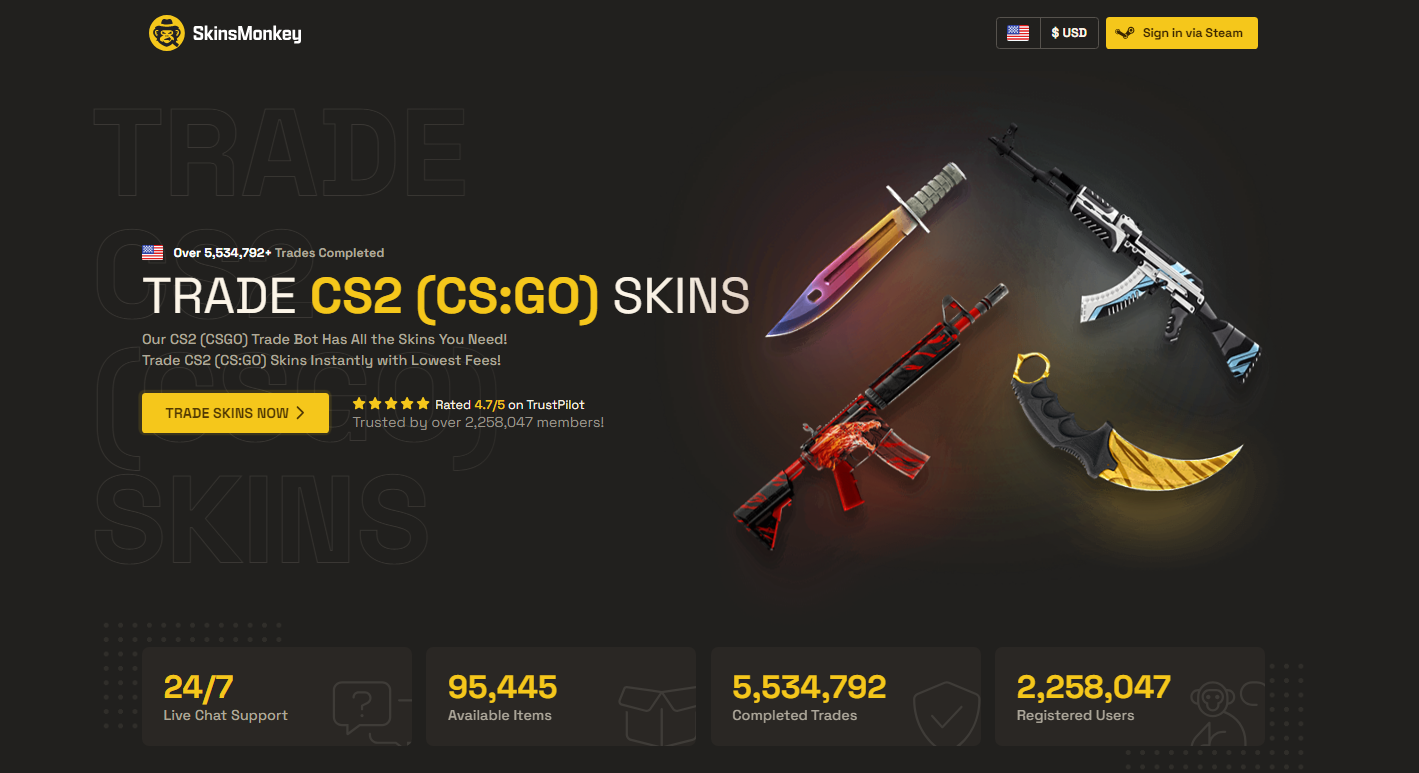

Trade Bots Unleashed: Your Secret Weapon in CS2 Trading

Unlock the power of trade bots in CS2 trading! Discover tips and tricks to maximize your profits and gain a competitive edge today!

How Trade Bots Revolutionize CS2 Trading Strategies

In the rapidly evolving world of Counter-Strike 2 (CS2), traders are constantly seeking innovative ways to gain an edge in the marketplace. Trade bots have emerged as powerful tools that revolutionize traditional trading strategies. By leveraging advanced algorithms and real-time data analysis, these bots can execute trades at lightning speed, ensuring that traders can capitalize on market fluctuations more effectively than ever before. This new technology allows users to automate their trading processes, reducing the emotional stress associated with decision-making and enabling them to focus on high-level strategy instead.

Moreover, the integration of trade bots not only enhances efficiency but also improves profitability in the CS2 trading landscape. For instance, many bots come equipped with features such as risk management tools, which can help traders minimize potential losses. Additionally, these bots can track historical data and market trends, providing valuable insights that inform future trading strategies. As the competitive nature of CS2 trading continues to grow, adopting automated solutions like trade bots is becoming increasingly essential for traders looking to stay ahead of their competitors.

Counter-Strike is a popular first-person shooter franchise that involves team-based gameplay and tactical combat. Players often encounter challenges, and one common issue is the cs2 server error, which can be frustrating for gamers seeking to enjoy a smooth experience.

Top 5 Trade Bots for Maximizing Your CS2 Profits

In the fast-paced world of Counter-Strike 2 (CS2), traders are constantly seeking ways to enhance their profits. Utilizing trade bots can significantly improve your efficiency and effectiveness in the marketplace. Here’s a look at the top 5 trade bots that have gained popularity among avid CS2 players:

- Bot A - Known for its user-friendly interface, this bot allows you to automate trades based on real-time market analysis.

- Bot B - This bot excels in executing high-frequency trades, maximizing your profit potential in a short amount of time.

- Bot C - With its advanced algorithms, it identifies trends and makes strategic trades that enhance overall profitability.

- Bot D - This is a community favorite, providing customizable options and in-depth analytics to track your trading success.

- Bot E - Known for its robust security measures, it ensures that your trades are safe and your investments secure.

When selecting a trade bot, it’s crucial to consider factors such as reliability, user feedback, and support options. Many traders report significant returns after implementing these bots into their trading strategies. Additionally, always remember to stay informed about market trends and keep updating your strategies accordingly. A successful trader not only relies on automated systems but also combines them with personal insights and market analyses for optimal CS2 profits.

Are Trade Bots the Future of CS2 Trading?

The rise of technology in trading has led many to question whether trade bots are the future of CS2 trading. These automated systems can analyze vast amounts of data and execute trades at lightning speed, far surpassing human capabilities. As trading environments become increasingly complex, a trade bot can help traders stay ahead of the curve by utilizing algorithms and machine learning to adapt to market changes. Furthermore, they eliminate emotional decision-making, providing a more disciplined approach to trading, which can lead to higher profitability.

However, while trade bots offer numerous advantages, reliance on automation also carries risks. Market volatility can lead to unexpected outcomes that even the most sophisticated algorithms might not effectively navigate. As we move toward a more digital trading landscape, it is crucial for traders to remain educated about the limitations of such tools. Ultimately, as technology continues to evolve, integrating trade bots into CS2 trading strategies could prove to be a dual-edged sword, combining both opportunity and risk.