Hydra Tech Insights

Stay updated with the latest in technology and gaming.

Term Life Insurance: The Safety Net You Didn’t Know You Needed

Discover the unexpected benefits of term life insurance and why it’s the safety net you can’t afford to ignore!

Understanding Term Life Insurance: Key Benefits for Your Family

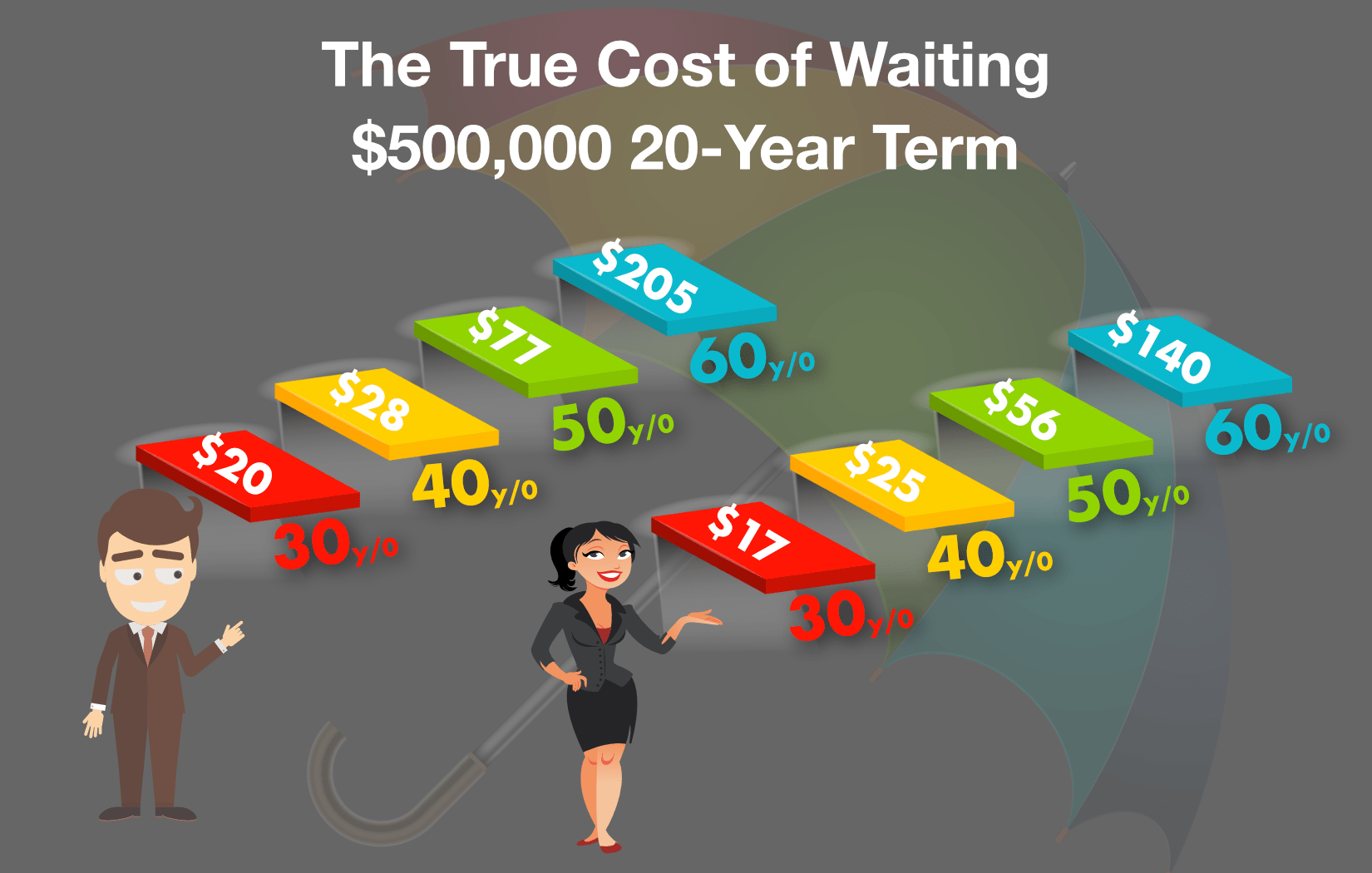

Term life insurance is a popular choice for families seeking financial security without the long-term commitment or high premiums associated with permanent life insurance policies. One of the primary benefits of term life insurance is its affordability; families can secure substantial coverage for a relatively low monthly premium. This allows policyholders to choose coverage amounts that can replace their income, pay off debts, or cover educational expenses for their children in the event of an untimely passing. Additionally, many term life policies offer the flexibility to convert to a permanent policy later, providing an added layer of security as your family's needs evolve.

Another significant advantage of term life insurance is its straightforward structure, making it easy to understand and manage. Families often find peace of mind knowing that if the insured passes away within the policy term, their beneficiaries will receive a lump-sum payment, referred to as the death benefit. This can be crucial in helping loved ones maintain their current lifestyle and meet financial obligations. For more detailed insights on the benefits of term life insurance, you can visit Investopedia or check out Policygenius.

Is Term Life Insurance Right for You? 5 Questions to Ask Yourself

Deciding if term life insurance is right for you requires careful consideration of your personal circumstances and financial goals. One crucial factor to evaluate is your dependents' needs. Do you have children or a spouse who relies on your income? If the answer is yes, term life insurance can provide financial security for your loved ones in the event of your untimely passing. Another important question to ask yourself is how long you will need coverage. Term policies typically last between 10 to 30 years, making them ideal for covering specific financial responsibilities such as a mortgage or education costs for your children.

Additionally, consider your financial obligations and long-term goals. Will your debts be paid off within the policy term? Are you looking for a way to replace your income during your working years? Reflecting on these aspects can help clarify whether a term life insurance policy suits your needs. Lastly, comparing term life insurance options from various providers can ensure you secure the best rates and coverage tailored to your situation. Don't hesitate to reach out to a financial advisor for personalized advice.

The Differences Between Term Life and Whole Life Insurance Explained

When considering life insurance, it’s essential to understand the differences between term life insurance and whole life insurance. Term life insurance provides coverage for a specific period of time, typically ranging from 5 to 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term. This type of policy is often more affordable due to its temporary nature and the absence of cash value accumulation. For a deeper insight, you can visit Investopedia.

On the other hand, whole life insurance is a type of permanent insurance that provides lifelong coverage as long as the premiums are paid. It includes a savings component that accumulates cash value over time, which the policyholder can borrow against. While the premiums for whole life insurance are generally higher than those for term policies, this form of insurance can provide financial security for dependents and serve as an investment tool. Learn more about whole life insurance at NerdWallet.